Disability Income Protection is an Employee Benefits Rising Star | JRW Associates, Inc., a Raleigh Benefit Advisory Firm

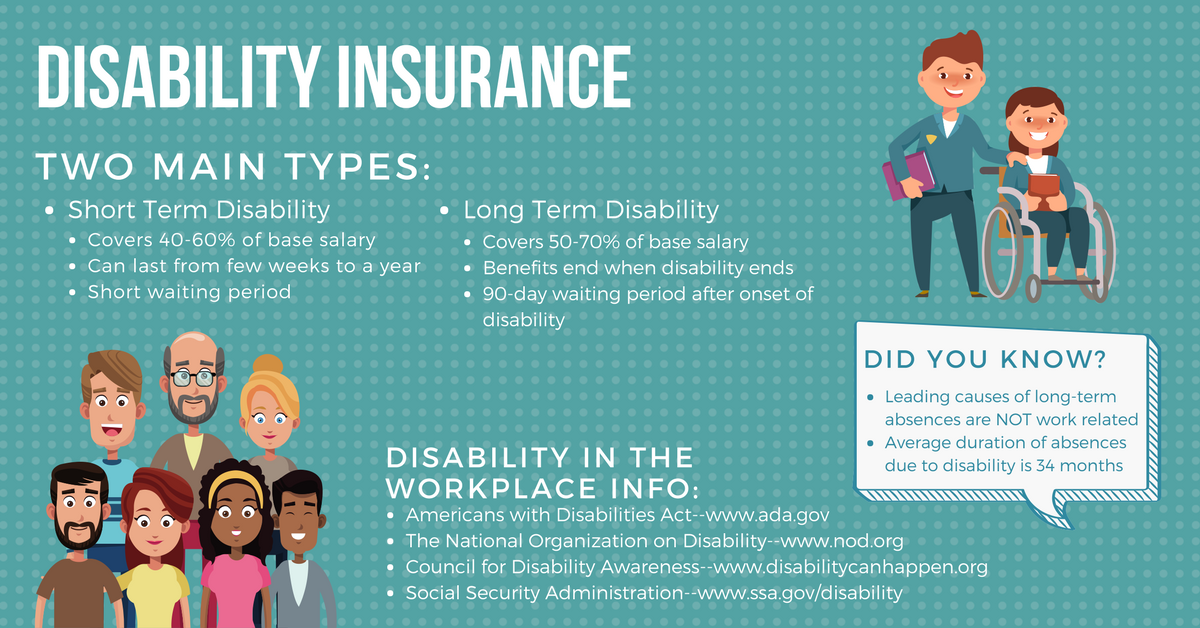

According to recent studies disability income is a rising star in the employee benefits market. This is due to a variety of factors. Most poignantly insurance company attempts to court and educate employee benefit advisers about the product, historically low national unemployment and financial impact of the recent tax reforms. In discussions with successful financial … Continued