CLAIMS SUBSTANTIATION FOR PAYMENT OR REIMBURSEMENT OF MEDICAL AND DEPENDENT CARE EXPENSES

CLAIMS SUBSTANTIATION FOR PAYMENT OR REIMBURSEMENT OF MEDICAL AND DEPENDENT CARE EXPENSES

A memorandum released by the IRS Chief Counsel responds to a request for assistance regarding the reimbursement of medical and dependent care expenses. Addressed is whether reimbursements of medical expenses from a health flexible spending arrangement (FSA) provided in a cafeteria plan should be included in an employee’s gross income if the expenses are not properly substantiated. The conclusion is that if any expenses, including those below a certain threshold, are not substantiated, the reimbursements must be included in the employee’s gross income.

The second issue concerns the method of substantiation for expenses. The document examines different scenarios, such as self-certification, sampling of expenses, not requiring substantiation for small amounts, and not requiring substantiation for charges with favored providers. The conclusion is that if a cafeteria plan does not require proper substantiation, it fails to operate in accordance with the regulations and the benefits must be included in the employee’s gross income.

Read the full description of the scenarios, an analysis of the relevant laws and regulations on income tax withholding and the regulations for cafeteria plans and substantiation of expenses.

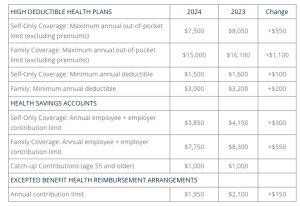

2024 LIMITS ANNOUNCED FOR HDHPS, HSAS, AND EXCEPTED BENEFIT HRAS

The Internal Revenue Service (IRS) announced the new limits for high-deductible health plans (HDHPs), health savings accounts (HSAs), and excepted benefit health reimbursement arrangements (EBHRAs).

The new limits for both HDHPs and HSAs will go into effect for calendar year 2024 while the HRA limits will go into effect for plan years beginning in 2024.

CLAIMS SUBSTANTIATION FOR PAYMENT OR REIMBURSEMENT OF MEDICAL AND DEPENDENT CARE EXPENSES

A memorandum released by the IRS Chief Counsel responds to a request for assistance regarding the reimbursement of medical and dependent care expenses. Addressed is whether reimbursements of medical expenses from a health flexible spending arrangement (FSA) provided in a cafeteria plan should be included in an employee’s gross income if the expenses are not properly substantiated. The conclusion is that if any expenses, including those below a certain threshold, are not substantiated, the reimbursements must be included in the employee’s gross income.

The second issue concerns the method of substantiation for expenses. The document examines different scenarios, such as self-certification, sampling of expenses, not requiring substantiation for small amounts, and not requiring substantiation for charges with favored providers. The conclusion is that if a cafeteria plan does not require proper substantiation, it fails to operate in accordance with the regulations and the benefits must be included in the employee’s gross income.

Read the full description of the scenarios, an analysis of the relevant laws and regulations on income tax withholding and the regulations for cafeteria plans and substantiation of expenses.

2024 LIMITS ANNOUNCED FOR HDHPS, HSAS, AND EXCEPTED BENEFIT HRAS

The Internal Revenue Service (IRS) announced the new limits for high-deductible health plans (HDHPs), health savings accounts (HSAs), and excepted benefit health reimbursement arrangements (EBHRAs).

The new limits for both HDHPs and HSAs will go into effect for calendar year 2024 while the HRA limits will go into effect for plan years beginning in 2024.